Get Free Access to Bonus Depreciation Funds

Receive a copy of the Bonus Depreciation Insider

844-293-3061

M-F

What do our clients get on the Revolution X Bonus Depreciation Marketplace?

OR CALL NOW

844-293-3061, Mon - Fri

Benefits of

Revolution X

Bonus Depreciation Marketplace

Examples from our

Revolution X Bonus Depreciation NNN Funds

Revolution X specializes in Bonus Depreciation funds. We’ll work with you to find the property or properties that fit your objectives as an investor.

All of our marketplace offerings have passed extensive due diligence analysis and are currently available for investment.

InCommercial Motor Fuel Fund III

Madison Links Car Wash Opportunity Fund

Madison Net Lease Fund IV

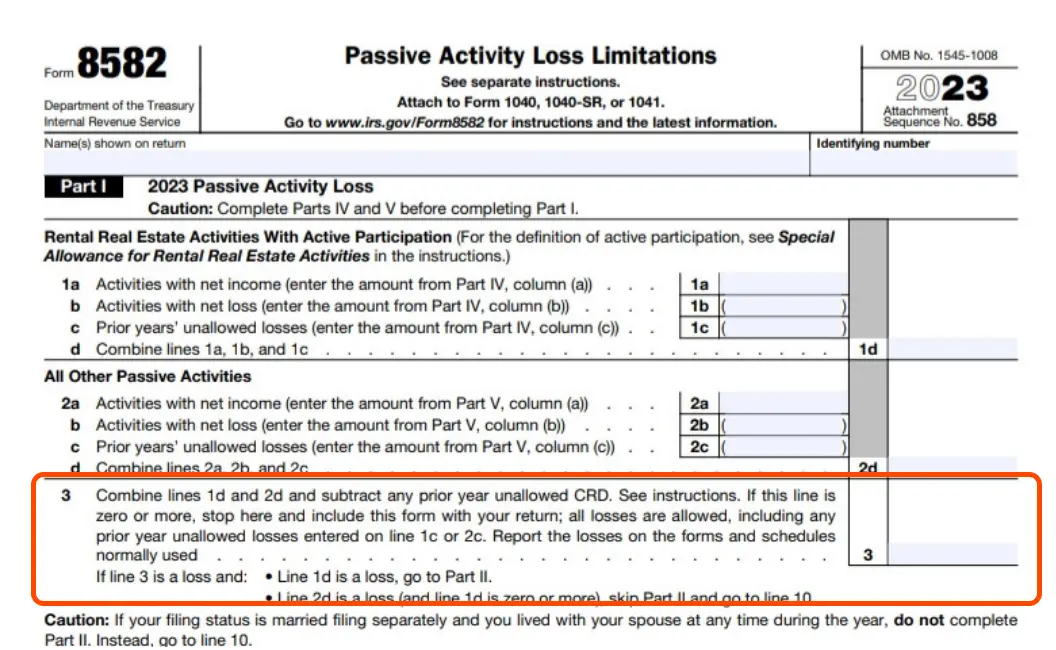

Form 8582 - Passive Income

If Line 3 is positive, the investor has passive income that should be investigated further.

We can't provide tax advice as we are neither tax professionals, nor familiar with any investor's particular set of facts and circumstances. Every investor should have their own, independent, competent tax representation.

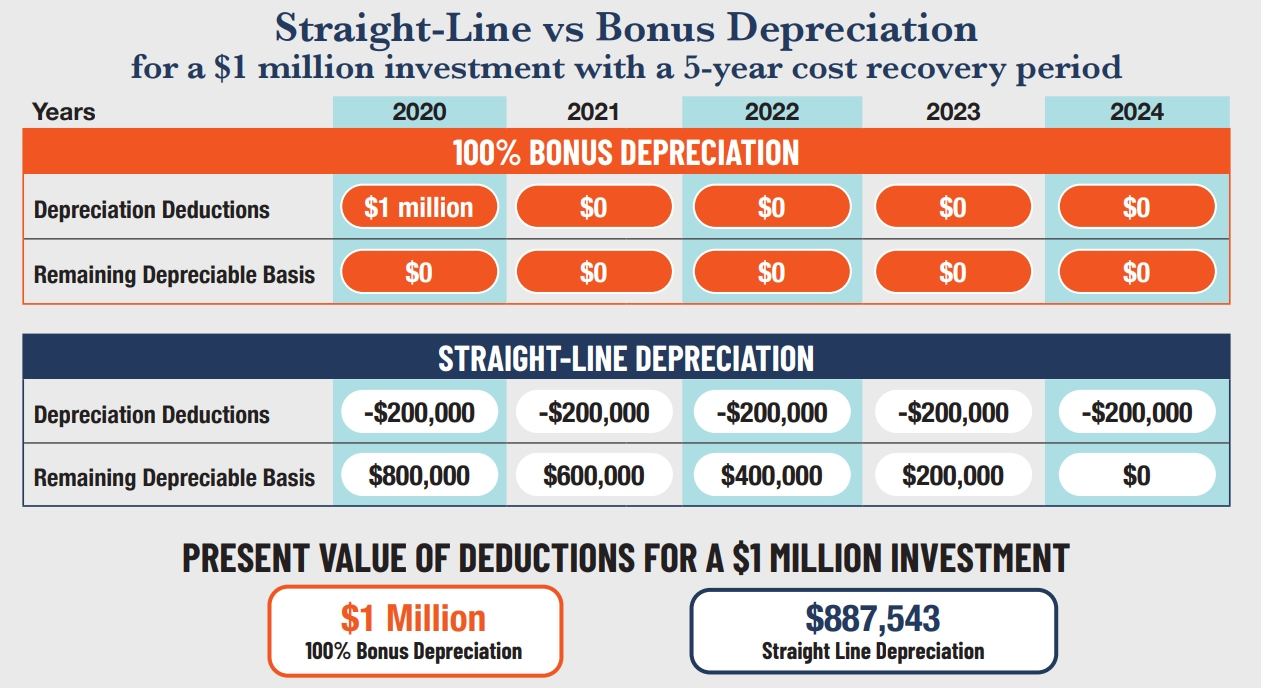

Accelerated depreciation and bonus depreciation are both methods used to accelerate the recognition of depreciation expense for tax purposes, but they operate differently and serve different purposes.

Method of Calculation

Accelerated Depreciation: Accelerated depreciation refers to any method of depreciation that front-loads depreciation expenses, meaning it recognizes a higher portion of the asset's cost in the early years of its useful life compared to the straight-line method. Examples of accelerated depreciation methods include double declining balance, sum-of-the-years'-digits, and MACRS. Accelerated depreciation can be used for financial reporting as well as tax purposes.

Bonus Depreciation: Bonus depreciation is a specific tax incentive that allows businesses to immediately deduct a significant percentage (often 100%) of the cost of eligible assets in the year they are placed in service. Unlike accelerated depreciation, which spreads depreciation expenses over the asset's useful life, bonus depreciation allows for an upfront deduction of a portion or all of the asset's cost in the first year.

Purpose

Accelerated Depreciation: Accelerated depreciation methods are used to reflect the idea that assets tend to lose their value more rapidly in the earlier years of their useful life. They can help align depreciation expenses with the actual pattern of asset usage and wear and tear. Accelerated depreciation is used for both tax purposes and financial reporting, providing flexibility for businesses to manage their taxable income and cash flow.

Bonus Depreciation: Bonus depreciation is a tax incentive designed to stimulate business investment and economic growth by providing an immediate tax benefit for purchasing new equipment, machinery, or other qualifying assets. It aims to encourage businesses to invest in capital assets by allowing them to deduct a significant portion of the asset's cost upfront, rather than depreciating it over time.

Eligibility

Accelerated Depreciation: Accelerated depreciation methods can be used for a wide range of tangible assets, subject to certain rules and limitations set by accounting standards. They are also commonly used for tax purposes, particularly through methods like MACRS.

Bonus Depreciation: Bonus depreciation applies specifically to certain eligible assets as defined by tax legislation. These assets typically include tangible property with a useful life of 20 years or less. The availability and percentage of bonus depreciation may vary over time due to changes in tax laws.

How Bonus Depreciation Works

Our Client Testimonials Speak for Themselves ...

The team at RevX have guided and educated clients into Inland Real Estate Group's investments since 2014. Inland Real Estate Group has enjoyed working together with RevX and look forward in our continued partnership.

-The Inland Real Estate Group

xxxxxxxxxxxxxxxxxxxxxxxxxxxxx

We were unaware that we could access pre-packaged real-estate portfolios that are eligible for Bonus Depreciation, that is until Frank & Bryan presented us with this strategy. Not only did a contribution into one of their bonus depreciation funds save me a significant amount of income tax, but the funds also provided a modest dividend distribution, a strong annualized IRR, and

several flexible exit-strategies.

-Jim G, Egg Harbor, NJ

The net result and tax aspects of the sale of our family business would have been significantly different, had we not had the opportunity to work closely with Bryan and RevX.

Our experience working together from our initial education phase to the executed closing, has been fantastic. We tell everyone we know that may be considering all planning options specific to a sale, to call Bryan first.

–N & R P., Daytona Beach, FL

These testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood of future results. These clients were not compensated for their testimonials. Please speak with your attorney and CPA before considering an investment.

As Showcased in these Leading Business Publications

Leverage Bonus Depreciation Opportunities

About Revolution X

Strategic. Personal. Accessible. Collaborative. Passionate about wealth creation. Dedicated to our clients and their well being. We’re a team of certified financial, tax and real estate specialists who are quietly and decisively changing how wealth management and 1031 Exchanges are planned for, managed and evolved. Find out more below. Even better, contact us and let’s get to know each other.

In an era of FinTech and Robo-Advisors, RevX has chosen to innovate wealth creation and preservation through our agile approach grounded in a personal and proactive touch. We are uniquely positioned to offer the lowest market advisory costs while providing cutting-edge investment options and solutions. Furthermore, our extensive knowledge and business background makes us uniquely suited to understand our client’s perspectives.

We began with a simple promise. It was a promise grounded in hard work and independent thinking. We pride ourselves in investment innovation at the intersection of technology, analytics and behavioral finance.

We match that promise with objectivity and agility. We have revolutionized the advisor and client relationship. We did so by asking our clients what they desired, and then we built it.

Nothing contained on this website constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through Arkadios Capital, member FINRA/SIPC.

*An investment in the Interests is speculative, illiquid, and involves a high degree of risk, including tax risk. There is no guarantee that the investor will receive any

return on, or even a return of their investment. Only investors who can afford the loss of their entire investment should consider investing in the Interests. A percentage

of the Offering Proceeds are anticipated to be deposited into a reserve to be maintained by the Manager to fund the Current Pay Return to the Class A Members.

However, there is no guarantee that any Current Payment will be made on time or at all, or that reserves will be available or sufficient to make the Current Payments.

See PPM for more detailed information.

**Tax benefits are not guaranteed and are subject to changes in the tax code.

Preferred return on invested capital before any profits are distributed to the sponsor.

*All offerings shown are Regulation D Rule 506c offerings.

*All DST properties shown are subject to availability. There can be no assurance that the DST properties shown will be available.

*Preferred return is not guaranteed and is subject to available cash flow. For further information about cash flow distributions from operations and capital events, please refer to the Private Placement Memorandum.

@2024. All Rights Reserved . Privacy Policy